If you’ve ever wondered how some people slowly build wealth without doing anything “extra,” the answer is usually one simple thing: compounding. And the easiest way to understand compounding is by using a compound interest calculator.

Don’t worry — you don’t need to be good at maths. When I first heard about compounding, I didn’t understand a thing either. But once you see how it works, the whole “money grows on its own” idea starts to make sense.

Let’s break it down in the simplest, most practical way.

🧮 So… What Exactly Is a Compound Interest Calculator?

Think of it as a small tool that tells you how big your money can become in the future.

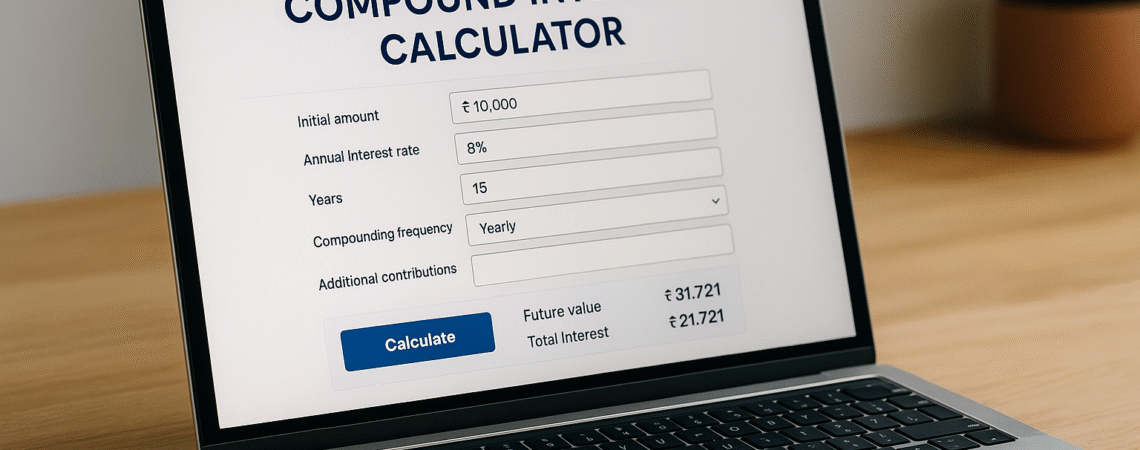

You enter a few things:

- How much money are you investing

- For how long

- At what interest rate

- And how often the interest is added

…then the calculator shows you the final amount.

It basically answers the question:

👉 “If I put in ₹X today, how much will it become later?”

Super simple.

Compound Interest Calculator

Calculate the future value of a lump sum plus optional monthly contributions. Choose interest rate, compounding frequency and term. Results in INR.

🔄 How Compounding Actually Works (In Real Life)

Here’s the easiest way to understand it:

- You invest some money (say ₹10,000).

- It earns interest.

- Next year, that interest also earns interest.

- Then the next year, the interest on the interest earns more interest.

This keeps repeating.

Over time, it feels like your money is working harder than you are.

That’s compounding.

📊 A Quick Example (You’ll Love This)

Imagine you invest:

- ₹10,000

- At 10% yearly interest

- For 10 years

Your money becomes:

👉 ₹25,937

So without adding anything extra, your ₹10,000 grows by ₹15,937.

And here’s the fun part:

If you stretch the time from 10 years to 20 years, the same ₹10,000 becomes…

👉 ₹67,275

All because time + compounding = magic.

📆 Monthly vs Yearly Compounding — Does It Matter?

Yes, a little.

- Yearly compounding → interest is added once a year

- Monthly compounding → interest is added every month

- Daily compounding → interest grows a tiny bit every day

More frequent compounding = slightly more money.

Nothing crazy huge, but enough to make a difference over many years.

🏦 Why Should You Use a Compound Interest Calculator?

Here’s what it helps with:

✔ Planning Your Future

Want to know how much your savings can grow by the time you’re 30? 40?

The calculator tells you instantly.

✔ SIP / FD / Savings Goals

You can compare different interest rates, amounts, and years in seconds.

✔ Motivation

Seeing your money grow on the screen gives you a small boost to save more.

✔ Realistic expectations

It shows your possible returns without guesswork.

💸 Real-Life Uses (Where People Actually Use It)

This tool isn’t just for “finance people.”

You can use it for:

- Planning a child’s education

- Checking how much your SIP can grow

- Seeing FD returns

- Retirement planning

- Saving for a car or house

- Even basic savings

It’s practical, not complicated.

🔧 How to Use the Calculator (Step-by-Step)

If you’re new to this, here’s all you do:

- Enter your starting amount

- Add yearly interest rate

- Select the time period

- Choose monthly or yearly compounding

- Hit “calculate”

That’s it.

In one click, you see the exact future value and total interest earned.

🧠 Golden Rule: Start Early

If there’s one thing compounding loves, it’s time.

Two people investing the same amount each month will get completely different results based on when they start.

- Start at 20 → massive returns

- Start at 30 → smaller

- Start at 40 → much smaller

Compounding rewards for early birds.

❓ Frequently Asked Questions

1. Do I need a big amount to start investing?

Not at all. Even ₹500 a month works because time does the magic.

2. Is compounding better than simple interest?

Yes, because your interest keeps growing, not staying flat.

3. Does compounding apply to SIPs?

Absolutely — SIP growth is compounding in action.

4. What compounding frequency should I choose?

Monthly is usually the most accurate and realistic.

🎯 Final Thoughts

A compound interest calculator is one of the most underrated financial tools out there. It shows you, in plain numbers, how your money can grow when you give it time and let compounding do its thing.

If you’ve never used one before, try it once.

You’ll instantly understand why investing early is such a big deal.

And the best part?

You don’t need to be a finance expert to use it — enter numbers and let the calculator show you your financial future.

🔗 Related Finance Tools & Calculators

If you’re planning savings or investments, these tools will help you calculate everything quickly and accurately:

👉 SIP Calculator

Calculate your monthly SIP growth and future returns with compounding.

👉 FD Calculator

Check how much your fixed deposit will grow based on bank interest rates.

👉 RD Calculator

Estimate returns for your recurring deposit with monthly contributions.

👉 CAGR Calculator

Find the average annual growth rate of your investments.