A GST Calculator online helps you compute the tax (GST) and final price for a product or service based on the applicable GST rate. It’s useful for merchants creating invoices, shoppers comparing prices, and accountants preparing bills. The main GST slabs in India today include 0%, 5%, 12%, 18%, and 28% — but rates and notifications are subject to change, so it is always advisable to check official sources. CBIC GSTClearTax

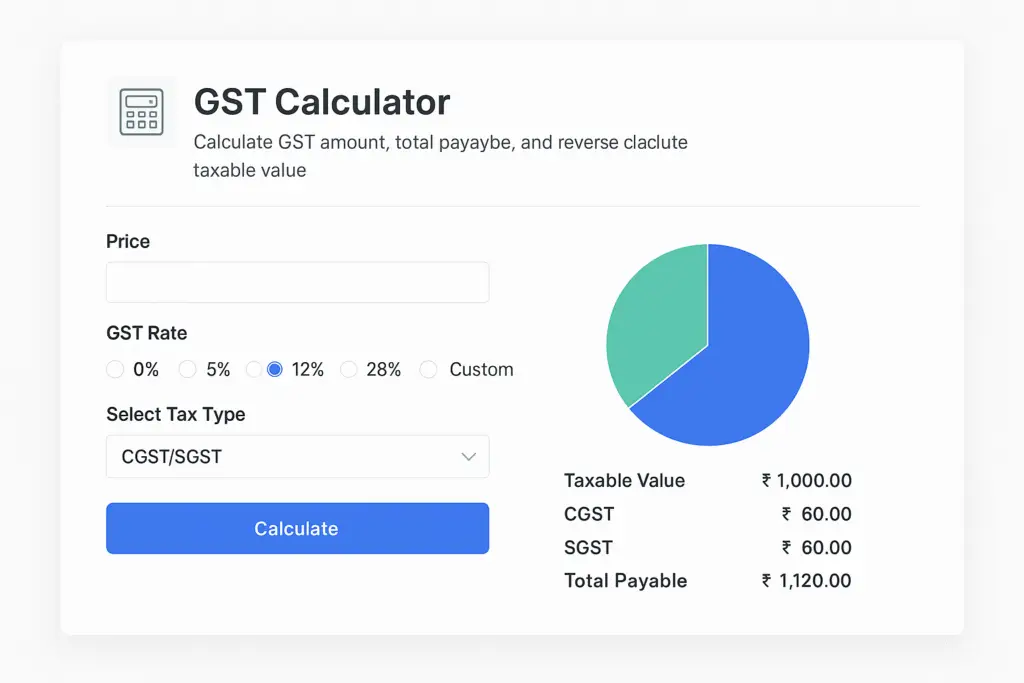

GST Calculator

Calculate GST amount and total price easily.

Disclaimer: This GST calculator provides approximate values for reference only.

What the Calculator Does (features)

- Calculate the GST amount from the taxable value and the rate.

- Compute total price (Taxable value + GST).

- Reverse calculation: get the taxable value when you have the inclusive price.

- Compare results across multiple GST rates (helpful when classification is unclear).

- Show breakup of CGST/SGST (intra-state) or IGST (inter-state) automatically.

How to Use the GST Calculator Online

- Select which price (taxable value or total inclusive price).

- Choose the GST rate (0%, 5%, 12%, 18%, 28% — or enter a custom rate). ClearTax

- Select CGST/SGST (intra-state) or IGST (inter-state).

- Click Calculate — you’ll see the GST amount, tax breakdown, and final payables.

Why This Tool Helps

- It prevents invoicing errors and saves sellers time.

- Quick price comparisons for buyers (with/without GST).

- Applicable for builders, e-commerce sellers, and small businesses who need fast tax math.

- Alerts you to rate changes: GST slabs have recently been discussed for simplification (possible consolidation to fewer slabs), so check council notifications for final changes. Reuters Goods and Services Tax Council

Income Tax Calculator

Estimate your income tax liability based on applicable tax slabs.

Calculate Tax →Percentage Calculator

Find percentage values easily for tax, price, and finance calculations.

Calculate Percentage →For an authoritative list of item-specific rates and notifications, refer to the official CBIC GST rates page. CBIC GST+1

FAQs — GST Calculator

Q1. Which GST rates should I choose?

Pick the slab (0/5/12/18/28) that applies to the good/service per HSN/description. Consult the CBIC/GST Council notifications or your tax advisor if unsure. CBIC GST Goods and Services Tax Council

Q2. Does the Calculator include cess or other surcharges?

Basic GST calculators show CGST/SGST/IGST. Cesses (e.g., on tobacco, luxury cars) and special additional duties must be added separately if applicable. Razorpay

Q3. Can I use it for both B2B and B2C invoices?

Yes, it computes numeric tax breakups usable in B2B and B2C invoices. To input GSTIN/ITC rules, integrate them with your accounting workflow.

Q4. Are GST rates changing soon?

There are active proposals and Council recommendations (in 2025) to simplify slabs — for example, proposals to reduce the number of slabs — but final adoption happens via GST Council notifications. Always cross-check before making pricing changes.